AMERICAN CANNABIS INDUSTRY NEARS $30 BILLION VALUE

AMERICAN CANNABIS INDUSTRY NEARS $30 BILLION VALUE The latest forecast from the data crunchers at BDSA has the U.S. cannabis industry growing to just south of $30 billion by the end of the year. Globally, they project the industry to be worth $36.7 billion in 2023 with roughly 80%, or $29.6 billion, of sales coming…

AMERICAN CANNABIS INDUSTRY NEARS $30 BILLION VALUE

The latest forecast from the data crunchers at BDSA has the U.S. cannabis industry growing to just south of $30 billion by the end of the year.

Globally, they project the industry to be worth $36.7 billion in 2023 with roughly 80%, or $29.6 billion, of sales coming from the U.S. state markets. BDSA is expecting the global marketplace to grow about 13% a year through 2027. The U.S. market is expected to be worth $45 billion by that time.

“Over the next five years, the biggest drivers of cannabis industry growth in the U.S. will be the thriving Midwest and East Coast markets,” said Roy Bingham, co-founder and CEO of BDSA. “New markets, especially adult-use markets like Missouri, New Jersey and New York, will lead growth. Although mature Western markets such as Colorado and California have experienced sales stagnation or decline due to price compression, they will continue to account for a substantial portion of legal sales through 2027.”

BDSA went on to cover some of the key numbers that will be playing into the growth. This includes the new Missouri market, which is expected to do $1.4 billion in sales this year. BDSA expects New York to do about $631 million this year but jump to $2.5 billion by 2027. New York sales are projected to see an annual compound growth rate of roughly 71%.

Then there are the markets that haven’t come online yet, even hypothetical ones like Florida play into the number where BDSA is expecting sales to start in 2025 and have a value of $4.3 billion per year by 2027. Minnesota, which legalized adult-use cannabis last month, will begin sales next year and is expected to do $117 million in sales next year and grow to $875 million by 2027.

The growth of midwestern cannabis markets is going well. Illinois is projected to do $2 billion in sales this year. Michigan has seen sales bump 19% in 2023 and the market is expected to be worth $3.5 Billion by 2027.

BDSA went on to note that here in California, the numbers are being impacted by the price of the pound crashing and the fact the illicit market still dwarfs the legal one. BDSA argues these are the main reasons California’s legal market saw a decline in sales for the first time in 2022. The report notes that based on the sales in the first quarter of 2023, the California market is expected to decline by 9% this year.

“California cannabis price compression emerged as a result of ongoing competition from the well-established illicit channel, and an oversupply of cannabis products as cultivation has ramped up in the legal channel since the start of adult-use sales in 2018,” Bingham told L.A. Weekly in an email. “This led to a decline in average retail prices beginning in Q3 2021. BDSA Retail Sales Tracking data show that equivalent average retail prices in California declined 21% between Q3 2021 and Q1 2023. Other mature markets, such as Michigan, have grown in total dollar sales despite price compression, but unit sales growth in California has not been strong enough to counteract price declines.”

Bingham went on to cover some of the positives that came out of the storm of 2022.

“While consumers benefited from more affordable cannabis, industry players had to adapt by optimizing operations and focusing on quality and brand reputation,” Bingham said. “The experience highlighted the need for strategic planning and a balanced regulatory framework in the evolving cannabis industry.”

Even with the decline in sales, California is still expected to represent a massive chunk of the U.S. cannabis industry for the foreseeable future.

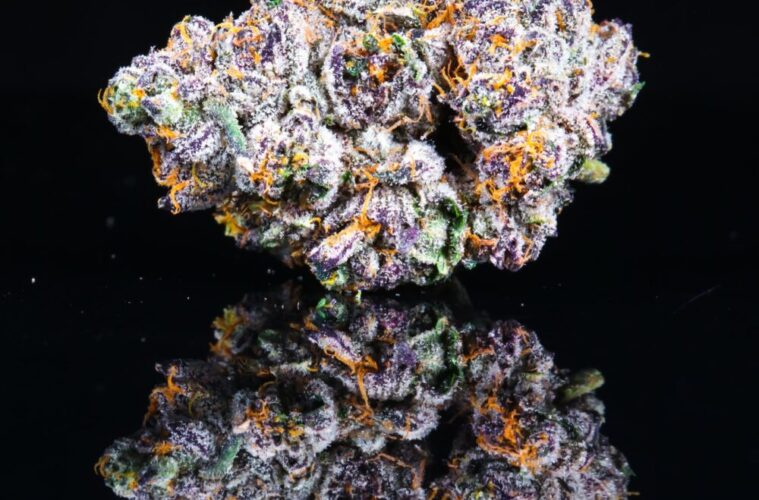

Photos courtesy of Ted’s Bud Co

Photos courtesy of Ted’s Bud Co

Photos courtesy CAM

Photos courtesy CAM